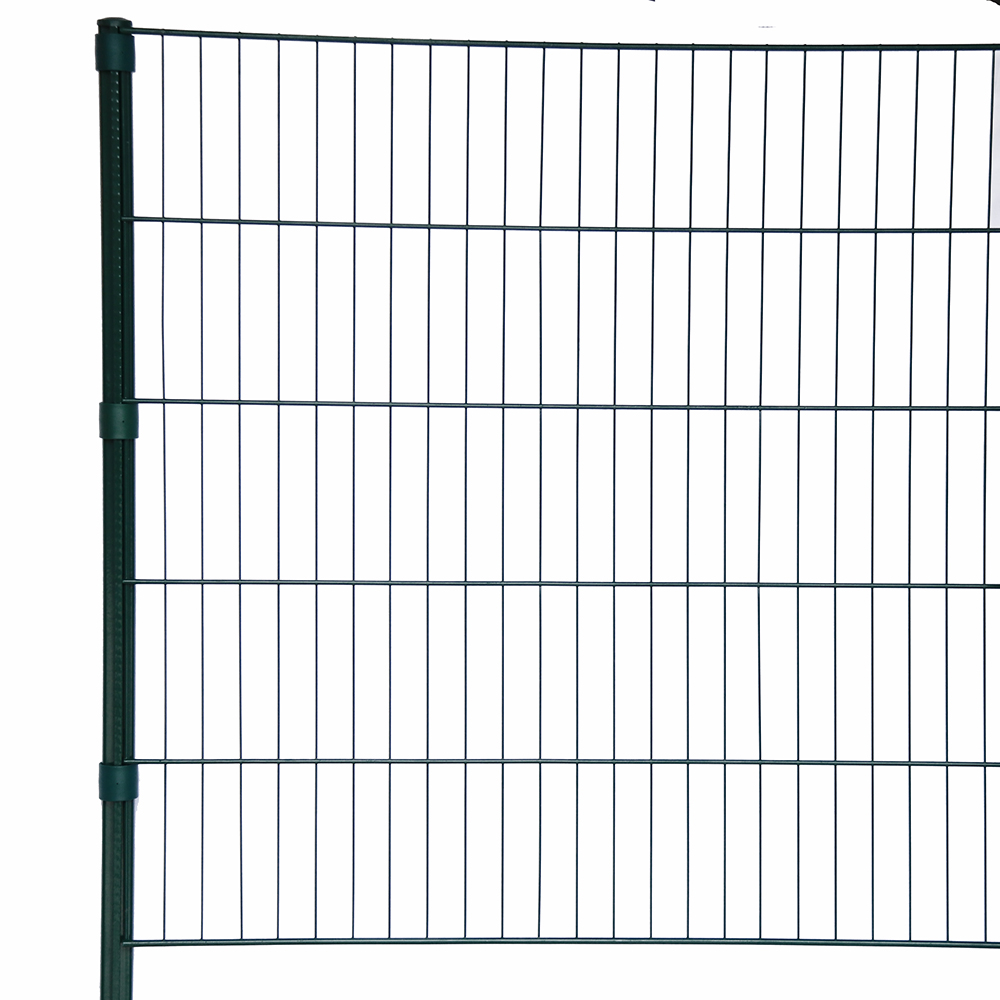

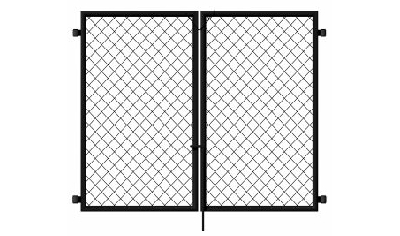

36 x 48 chain link gate

نوفمبر . 08, 2024 19:27

Exploring the Intersection of Chainlink and Web3 A Spotlight on 36% X 48% Gate

The excitement surrounding blockchain technology and the emergence of Web3 have revolutionized various sectors, particularly in finance, supply chain management, and digital identity. Among the notable developments in this arena is Chainlink, a decentralized oracle network that enables smart contracts to securely interact with real-world data. In this article, we will explore how Chainlink operates and the potential implications of a hybrid model referred to as the 36% X 48% gate, emphasizing its significance in the unfolding narrative of decentralized finance (DeFi) and beyond.

The Role of Chainlink in Smart Contracts

Chainlink's core functionality lies in bridging the gap between blockchain networks and the external world by providing accurate and reliable data feeds. Smart contracts, self-executing contracts with the terms of the agreement written into code, rely heavily on data inputs to trigger automated processes. However, the blockchain's inherent isolation makes it challenging for these contracts to access off-chain data. Chainlink addresses this limitation by utilizing a decentralized network of oracles, which are nodes that verify and transmit external information to smart contracts.

The utility of Chainlink's oracle services extends across numerous applications, including price feeds for cryptocurrencies, event outcomes for insurance claims, and supply chain tracking. This adaptability positions Chainlink as a fundamental player in the growth of DeFi, where smart contracts operate autonomously based on predetermined conditions.

Understanding the 36% X 48% Gate

The concept of the 36% X 48% gate is an intriguing prospect that suggests a hybrid approach to engaging with Chainlink’s oracle services while managing risk and optimizing performance. This model proposes that users allocate 36% of their resources to utilizing Chainlink’s oracles for high-impact, real-time data needs (the 36% portion), while the remaining 48% focuses on various risk management strategies and alternative data sources (the 48% portion).

36 x 48 chain link gate

By utilizing this gate strategy, participants in the DeFi space can create a balanced approach that leverages the strengths of Chainlink's reliable data feeds while diversifying their risk exposure. For instance, within the context of a decentralized lending platform, the 36% allocation could be used for price feeds to ensure accurate valuations of collateral assets, while the 48% could focus on leveraging data from different markets to assess borrower risk more comprehensively.

The Implications of the 36% X 48% Gate

Adopting the 36% X 48% gate framework has several potential implications for users and developers within the blockchain ecosystem. First, it encourages a balanced investment strategy that recognizes the volatility of blockchain assets while still harnessing the power of Chainlink’s valuable oracle services. Through risk distribution, it may reduce the likelihood of catastrophic failures resulting from singular dependency on any one data source.

Moreover, this hybrid model advocates for a more sustainable ecosystem, as participants can continuously reevaluate their strategies based on dynamic market conditions. The flexibility allowed by the 36% X 48% gate can create an environment ripe for innovation, as projects explore different ways to integrate oracles with alternative data streams, fostering enhanced decision-making processes.

Conclusion

As the blockchain landscape continues to evolve, the interplay between reliable data provision and innovative risk management strategies will be crucial. Chainlink’s pivotal role as a decentralized oracle network positions it at the forefront of this transformation. By examining frameworks such as the 36% X 48% gate, we can glean insights into more sophisticated approaches that balance opportunity and security in the ever-expanding Web3 ecosystem. As we venture deeper into this new frontier, it is essential for participants to adopt strategic frameworks that not only optimize potential returns but also safeguard against the inherent risks that accompany the digital revolution. By leveraging robust solutions like Chainlink and innovating around hybrid models, the future of decentralized finance—and indeed, the entire blockchain space—will become more resilient and dynamic.