Current Price Trends for Chainlink Gates and Their Market Implications

نوفمبر . 27, 2024 08:16

Understanding Chainlink Gate Prices A Comprehensive Overview

Chainlink has emerged as a significant player in the blockchain ecosystem, primarily due to its unique utility in providing real-world data to smart contracts. This decentralized oracle network enables data aggregation from multiple sources, ensuring that blockchains can interact with external data feeds securely and reliably. As the demand for blockchain solutions grows, particularly in decentralized finance (DeFi), the pricing of Chainlink services, including oracle access and information provision, becomes a topic of keen interest. This article delves into the factors influencing Chainlink gate prices and their implications for users and developers.

What are Chainlink Gate Prices?

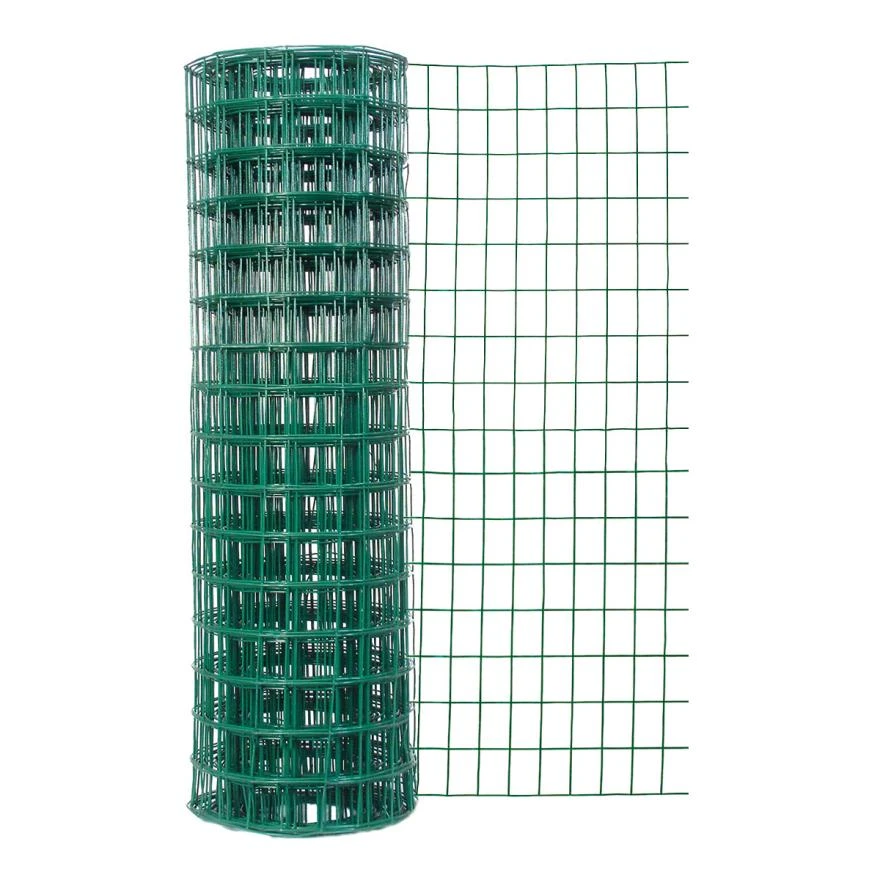

Chainlink gate prices refer to the costs associated with accessing Chainlink's oracle services. They represent the fees paid by users and developers to utilize Chainlink’s data feeds for various applications, whether in finance, insurance, gaming, or supply chain management. These prices can vary greatly depending on several factors, including network congestion, the complexity of data being requested, and the specific data providers involved in the transaction.

Factors Influencing Chainlink Gate Prices

1. Demand and Supply Dynamics Like any market, Chainlink gate prices are heavily influenced by the principles of demand and supply. As more developers and projects look to integrate Chainlink's services, the demand naturally increases. Higher demand can drive prices up, particularly if supply constraints exist, such as limited availability of reputable data providers.

2. Network Usage The overall activity on the Ethereum network (or other chains that Chainlink supports) can impact gate prices. If the network experiences congestion due to high transaction volumes, fees—often referred to as 'gas prices'—can increase sharply. This increase affects the cost structure of oracle access on Chainlink, potentially leading to higher gate prices for users.

3. Quality of Data Providers Chainlink’s unique selling proposition is its ability to aggregate data from multiple trusted sources. The fees for data from high-quality, reputable providers may be higher than those for lesser-known or lower-quality sources. Projects requiring specific data sets or specialized sources may need to pay a premium, thus influencing the gate prices they encounter.

chain link gate price

4. Security and Reliability The significance of secure and reliable data provisions cannot be overstated, particularly in industries like finance and insurance where even minor discrepancies can lead to significant financial losses. Consequently, users might opt to pay more for services that guarantee enhanced security measures, reliability, and real-time data updates.

5. Technological Developments Continuous improvements and advancements in Chainlink's technology can also affect pricing. As new features or enhancements are rolled out, the added value might justify higher gate prices. Conversely, the introduction of more effective or efficient protocols could result in lower costs for users.

Implications of Chainlink Gate Prices

For developers and businesses integrating Chainlink into their projects, understanding gate prices is crucial for budgeting and overall project viability. High gate prices may deter some projects from utilizing Chainlink or require them to reconsider scaling plans. Additionally, businesses must navigate the trade-off between cost and the quality of data they receive, ensuring that they choose the right balance for their specific needs.

For end-users, being aware of how gate prices can fluctuate based on the aforementioned factors enables them to make informed decisions about engaging with decentralized applications that rely on Chainlink's services. Users should always consider the potential costs associated with smart contracts and decentralized applications that utilize Chainlink oracles, especially as the market continues to evolve.

Conclusion

As the DeFi landscape grows and requires increasingly sophisticated solutions, Chainlink’s role in providing reliable data feeds is set to expand. Consequently, understanding the dynamics of Chainlink gate prices will be crucial for developers and businesses alike. By being mindful of the factors influencing these prices and staying updated on technological advancements within the Chainlink ecosystem, stakeholders can better navigate the complexities of integrating blockchain technology into their operations. Thus, careful consideration of Chainlink gate prices not only fosters informed decision-making but also contributes to the overall success of blockchain-based applications.

Unity

Unity Creation

Creation Challenge

Challenge Contribution

Contribution